Question: We are first time homebuyers. What is going on with this crazy buyer’s market?

Saturday, March 19, 2022

Crazy Buyers Market Question and Answer

Zip Liner Traffic

Zip Liners find congestion down the line!

https://www.youtube.com/watch?v=TyjMyY1JFYk

Friday, March 11, 2022

The Incredible Sellers Market

Wednesday, February 23, 2022

Real Estate Market Report

Here is a quick and to the point Real estate market report:

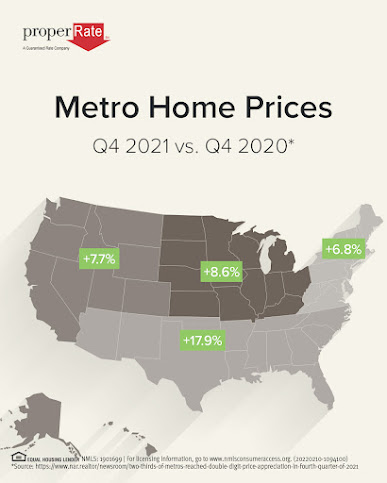

1. It is a fantastic sellers market in Illinois and Indiana.

2. Sellers cannot lose if they sell their home through a Real estate company. (Especially through us).

For example....if a Home price is listed lower, there will be more buyers and the competition will create a multiple offer situation, and ultimately a higher sales price.

If a seller Prices their home a little higher, there will be less buyers, but still, the home will go for a bit more than listing price.

3. Appraisers are the only ones who can burst your bubble and tell you that your home has sold for too much. Yes, even though the buyer qualifies for that sale price and still wants your home at this higher price. But....

We have an excellent system, that we present to the appraisers, so your home sale price is approved by the appraiser or at the very least, close to the agreed upon price.

This is called "Our 30+ years of Experience bonus to you."

4. Homes are selling fast when you use a Real estate brokerage. Our last 3 sales sold in less than 5 days. All with multiple offers.

5. Sellers can choose the best offer, because there are multiple offers to choose from. Best offer is not only price, but also amount of down payment, type of financing or cash offer. We can advise you all the way.

6. Sellers can dictate the terms of the sale.

These include possession time, closing date and amount of Earnest money deposit.

7. These remarkable home prices may not last with the current economic conditions of the country. Many buyers may lose there qualifying status. Fewer buyers means lower demand, and prices could stabilize or fall. Nothing lasts forever, as you well know.

If you've been considering a move, now is a great time to sell your home.

Call us, we will always protect your interests and provide marketing that reaches all qualified buyers.

Our experience will yield a higher sales price, there is no doubt about this. And, we know how to solve the many problems that arise when selling a home.

That's why we have been in business for over 30 years, with the majority of our business coming from client referrals.

Interesting USA Facts

Nearly one out of every 715 people in the US died from coronavirus in 2021. That's 464,000 people.

In 2021, 34 million Americans tested positive for COVID-19, up 70% from 20 million in 2020. As of January 31, 2022, 75% of the population had received at least one COVID-19 vaccine. Twenty-seven percent had received a booster shot. Personal healthcare spending was $3.4 trillion in 2020, a 4.5% increase from 2019. Twenty-eight million Americans (8.6% of the population) did not have health insurance in 2020, up from 8% in 2019. Preliminary data shows that 3.4 million people died in 2021, 13% more than in 2019. The top three causes — heart disease, cancer, and COVID-19 — accounted for 50% of deaths. The federal government spent $141 billion on public health in 2021 — a 21% decrease from 2020, but more than double its 2019 public health spending.Friday, February 11, 2022

Neighbors Tree is Blocking My View

Question: About five years ago I contacted a neighbor whose tree was obstructing our view. Granted the tree has been slow growing, but it still blocks some of our view. Though I offered to pay for its removal, she declined my offer, and I respectfully let it go. She was elderly, and when she died I respectfully contacted her daughter and again asked that the tree be cut down. The daughter said that she would sell the house and it would be up to the new owners. Other neighbors who also have obstructed views have contacted me and asked me to please find a solution. We all know that our property values are being adversely affected by this problem. What can we do?