Monday, April 19, 2021

Sunday, April 18, 2021

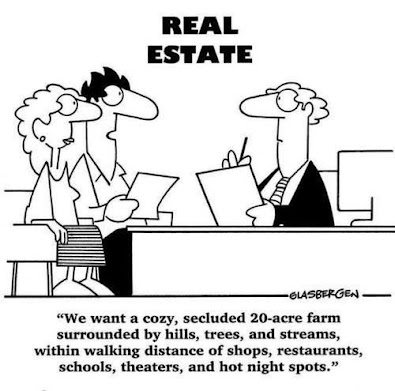

Home Inspection, Now an FHA Inspection?

Question: I knew I would have to go through the buyer’s inspection when I accepted this contract, but now I am told that FHA has to inspect my Home and that the repairs they require must be completed in order for the buyer to get their loan. I am not happy about this. Is this correct?

Answer: First of all, congratulations on getting an accepted offer on your home. In many markets, that is not easy to do. But that does not mean that the deal will close. Contracts have contingencies that must be satisfied in order for a closing to take place. Example: Contingent on your buyer getting a loan, Contingent on a satisfactory home inspection, Contingent on your home appraising to at least the purchase price, etc.

If you have a buyer who is obtaining FHA financing, your deal is also contingent on you completing the repairs required by the FHA inspector/appraiser. The FHA inspector is an appraiser sent to determine the value of the home and look for significant deficiencies according to FHA criteria such as obvious mold growth, chipped paint on windows older than 1978, broken glass, lack of GFCI’s by sinks, etc. If they find defects then they will require repairs which they will reinspect, to ensure the repairs were made correctly.

These required repairs are usually minor if the homeowner has kept their home in good shape.

You are not required to do these repairs. You may say no and look for another buyer that is obtaining conventional financing or paying cash. The problem is that in many markets, the vast majority of all qualified buyers are using FHA financing.

The smart move would be for you to do the repairs and enjoy your check at closing.

Will Checking My Credit Score Online Hurt my Credit My Score?

However, if you check your score yourself, there will be no effect whatsoever. When you actually apply for credit, it triggers what’s known as a “hard inquiry,” which can damage your score.

However, if you’re just checking your own score, or if a lender is performing a routine review of your account, that’s known as a “soft inquiry,” and it has no effect on your credit

Subscribe to:

Posts (Atom)