I went to the closet to store a few toys.

When I opened the door there was nothing but noise.

Box after box fell onto the floor,

It took all my power to close that big door!

Down to the basement to store all that stuff.

I was looking for room, but there wasn't enough.

So out to the garage to find some more space.

But it was loaded with boxes all over the place.

It's time to move, this house is too small.

I'll get on the phone and give my banker a call.

He looked at my numbers and said you're Approved!

Let's start packing our stuff and get on with this move.

We're looking at homes, we'll know we'll find one.

But after 36 viewings, there really were none.

Ugly Green carpet, everything outdated,

The ads on these homes were way overrated.

We asked our Realtor, is there anything nice?

She said, yes there is, but you'll have to up your price.

We weren't very happy, she could see on our face.

She said $10,000 higher and you'll find a nice place.

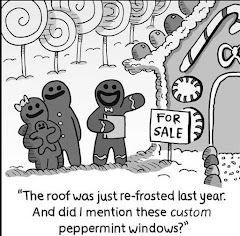

The home on Elm street was pretty as a picture.

With beautiful flooring and outstanding fixtures.

Granite counters and Stainless Steel.

We can see this home is a really good deal.

The look on out face went from frown to smile.

We had found our dream home, but it did take a while.

It has triple the space, this home is just great!

Let's make an offer before it's too late.

Seller's accepted out offer, we are so delighted.

Plus nervous and anxious, but definitely excited.

Christmas in our new home, because the closing is near.

And Merry Christmas to you and a Happy New Year!