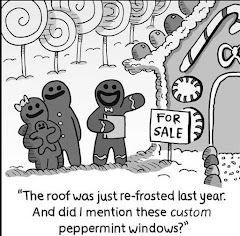

Question: We are first time homebuyers. What is going on with this crazy buyer’s market?

Answer: Any prospective buyer who thought last year’s dramatic jump in home prices was rough, should be prepared for this spring to be even worse. A home buyers nightmare of fast-rising housing prices, increasing mortgage rates, and record-low inventory of homes for sale is likely to present a tough real estate market for those looking to purchase a new home.

The nation has been stuck in a housing shortage for a while now, but it’s now grappling with the fewest homes for sale ever. The lack of inventory is happening at the worst possible time as more Americans are hitting their prime home-buying years—and not finding anything on the market. The Covid Pandemic has only accelerated the problem as buyers sought out more spacious homes.

Buyers will probably pay more for housing, as prices continue accelerating. Last year, all-time-low mortgage rates helped to offset the higher prices. But buyers won’t find that relief this spring now that rates are at 4+% - which may significantly increase a borrower’s mortgage payment.

That doesn’t mean it will be impossible to successfully purchase a home, it just won’t be easy.

The competition from other buyers could thin out a bit as more folks are priced out of homeownership. If there’s less demand, it could mean fewer (or at least less heated) bidding wars that don’t result in mind-boggling offers over the asking price.

It would make sense that, as mortgage rates rise, home prices would fall or at least stabilize. Logic would suggest that there has to be some limit on how much buyers can afford to spend on housing. Right?

Nonetheless, in the short term, instead of prices stabilizing, they’ve been shooting up at a faster clip, as home shoppers rushed into the market hoping to lock in a home at a low mortgage rate before rates rise even further.

Are home prices going to fall in the near future? It would require a tsunami of newly built homes going up for sale for prices to stop their seemingly unstoppable rise. And that doesn’t seem likely as builders have struggled to ramp up construction and the demand for housing just keeps growing.

Rising interest rates and a very unstable economy are factors to watch!