1. Limited competition

In December, there’s no competition to speak of. Other (saner?) buyers are at home, gathered around the Christmas tree, opening gifts and preparing a big dinner.

2. Tax benefits

Looking for some end-of-year tax deductions? If you close your home purchase before the end of the year, you can deduct certain costs from your 2016 tax return. They include:

- Mortgage interest

- Loan points

- Property taxes

Remember, mortgage interest costs tend to be especially high in the early years of a home loan. So, this could be a nice last-minute tax break for your family.

3. Desperate sellers

With the holidays looming and a new tax year nearly upon them, sellers who put their homes on the market in December might be especially motivated to close the deal and start the new year fresh.People can be forced to sell in December for several reasons. They include:

- A death in the family

- Financial pressure

- Job relocations

4. You get a realistic look at properties

Winter home-shopping allows a chance to see real-estate properties in a clearer light. With flowers gone and curb appeal at a minimum, shoppers can more easily focus on the permanent features of the home.

As you tour a property, pay attention to things such as:

- How well the home is insulated.

- Whether you feel cold drafts.

- Whether the window seals seem tight.

- How well the furnace is working.

Another advantage to winter shopping is that your inspector will get a good look at the home while it is under the stress of lower temperatures, winds, snow and rain.

5. Rates still are low

Mortgage rates are not as low as they were last year, but they still remain attractive compared with historical norms. For example, the interest rate on the average 30-year fixed-rate mortgage is just 4.03 percent, according to Nov. 23 weekly data from FreddieMac.

However, rates have been on the upswing lately. For example, the 30-year fixed-rate mortgage averaged just 3.57 percent a couple of weeks ago. Rates fluctuate, of course, but the large recent rise is a reminder that low rates might not last forever.

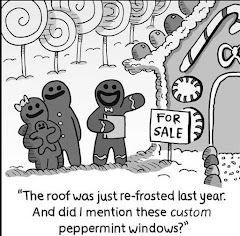

The downside: selection

The bummer about winter house hunting is that, even if you are not the type of shopper who needs to try on 20 pairs of shoes before making a purchase, you probably will be frustrated by the thin selection of properties on the market.

The odds aren’t great that you’ll find the home you envisioned. But house-hunting is like that anyway. Unless you’re building a custom home or buying a new home from a builder who offers you the chance to make pre-construction choices, you’ll always face compromises.