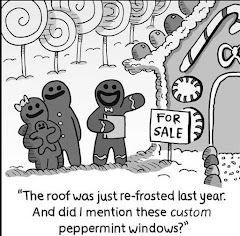

Spectacular, contemporary home that has the feel of a Frank Lloyd Wright

Home. Over 7500 sq ft of finished living space on 1.6 Acres. Addition added in

1990. Huge Living & Dining rooms w/ hardwood floors & fireplace.

Panoramic windows look onto the pictuesque grounds. Unique Kitchen with Granite

counters, Sub Zero refrigerator & Viking Oven-Range. Large windows look onto

the front Courtyard. Stunning Family room addition w/ Panoramic windows,

fireplace and a roof designed to provide a visible waterfal during rainfall,

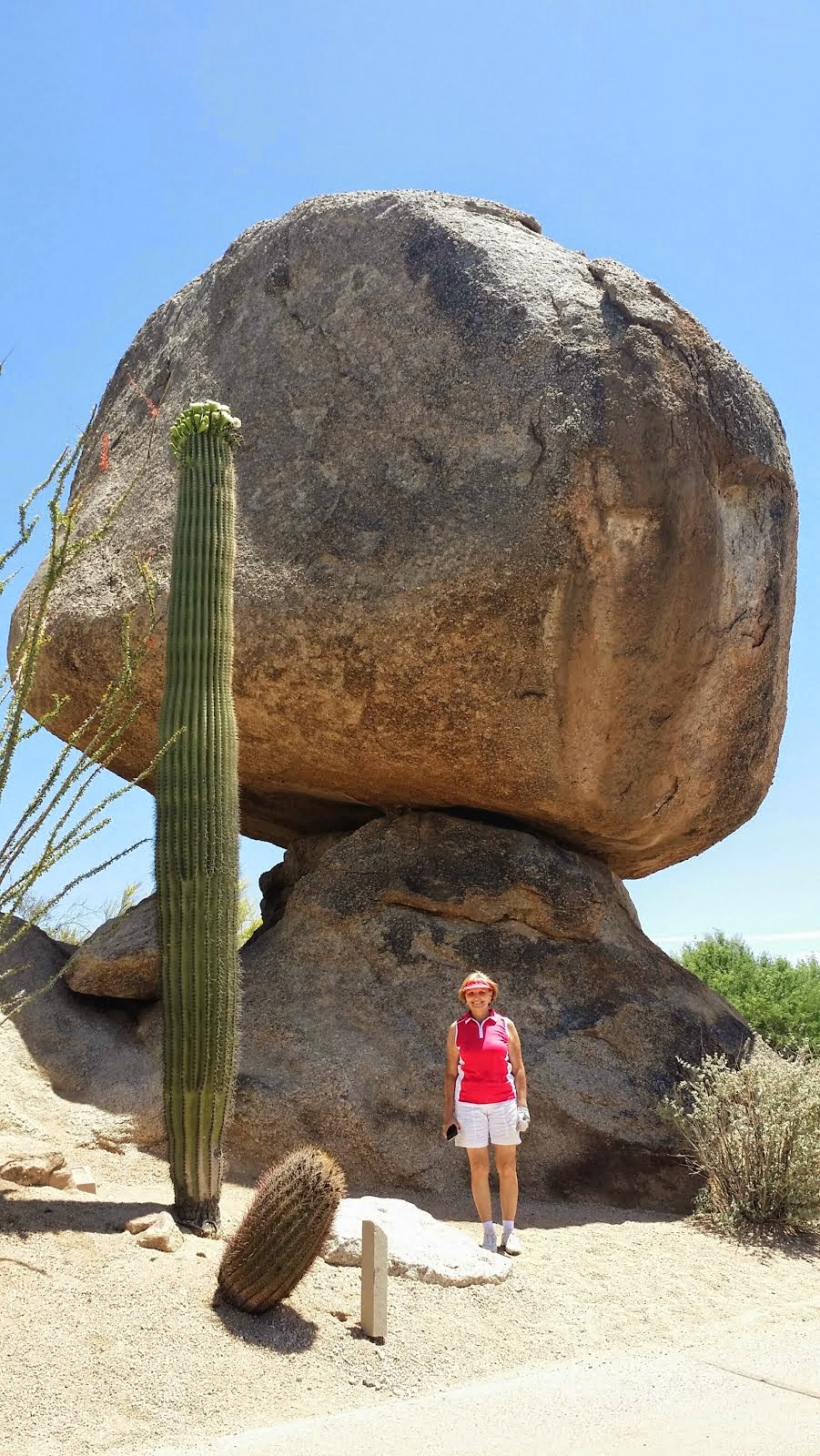

that splashes onto the rock formation on the side of home. Numerous skylights

thruout the home provide a lot of natural lighting. Breakfast patio looks onto

the garden & art sculptures.

Check this property out on the Norton Safe Link:

http://www.coldwellbankeronline.com/ID/3289230