Multiple factors have contributed to the current slump in the housing market. One of the major causes of the current slump, however, can be attributed to the fact that more and more people have been using their homes as ATM machines. Whenever they want or need something that they cannot afford, instead of saving for it or denying themselves the luxury, they've simply borrowed against the equity in their homes.

Years ago, this problem was not as widespread as it is today for one simple reason: People tended to buy what they could afford; they worked hard to pay down their debts. For many homeowners, their goal was to have their home paid for by the time they retired, so they would not have a house payment in their golden years. In today's buy-now-pay-later society where there is a fine line between need & desire, we have become much more vulnerable to slumps in the housing market. Now, when a slump hits, we cannot even rely on the equity in our homes to pad the fall.

For some, this message probably comes too late, but for other’s it’s not. Work toward building up equity in your home. Work closely with your loan officer to find the lowest-cost loan available, and then pay down the principal on or ahead of schedule. If hard times hit, you then have a cushion to fall back on. Remember, that when we read the gloomy, often-times sensationalistic, real estate news, you need to remember that homes are still selling & real estate is still a great investment.

Years ago, this problem was not as widespread as it is today for one simple reason: People tended to buy what they could afford; they worked hard to pay down their debts. For many homeowners, their goal was to have their home paid for by the time they retired, so they would not have a house payment in their golden years. In today's buy-now-pay-later society where there is a fine line between need & desire, we have become much more vulnerable to slumps in the housing market. Now, when a slump hits, we cannot even rely on the equity in our homes to pad the fall.

For some, this message probably comes too late, but for other’s it’s not. Work toward building up equity in your home. Work closely with your loan officer to find the lowest-cost loan available, and then pay down the principal on or ahead of schedule. If hard times hit, you then have a cushion to fall back on. Remember, that when we read the gloomy, often-times sensationalistic, real estate news, you need to remember that homes are still selling & real estate is still a great investment.

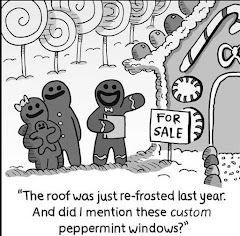

The Home in the picture is located at 1263 River Dr in Calumet City. The owners have completely updated this home and added so many extras. 4 bedrooms. 2 baths. Full basement. One of the bedrooms has a 3 season sunroom attached to it. Private location. Large lot. Find out more at: www.Cathyhiggins.com (view my listings)